TFSA vs RRSP vs Both. What’s Best for Me?

Which is better—a TFSA or an RRSP? That’s kind of like asking, “Which is better—a t-shirt or a sweater?”

Fundamentally, they do the same thing—t-shirts and sweaters both keep you covered, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) both let you save money for the future. But the way they do it is different, and which one you choose depends on your needs.

That being said, sometimes it’s good to wear a t-shirt and throw on a sweater if it gets chilly. In the same way, TFSAs and RRSPs can work together depending on circumstances.

But choosing the right one can feel like a guessing game. Don’t worry—it isn’t. In this article, we’ll look at how TFSAs and RRSPs work, how they’re different and how to pick the best investing account for your goals.

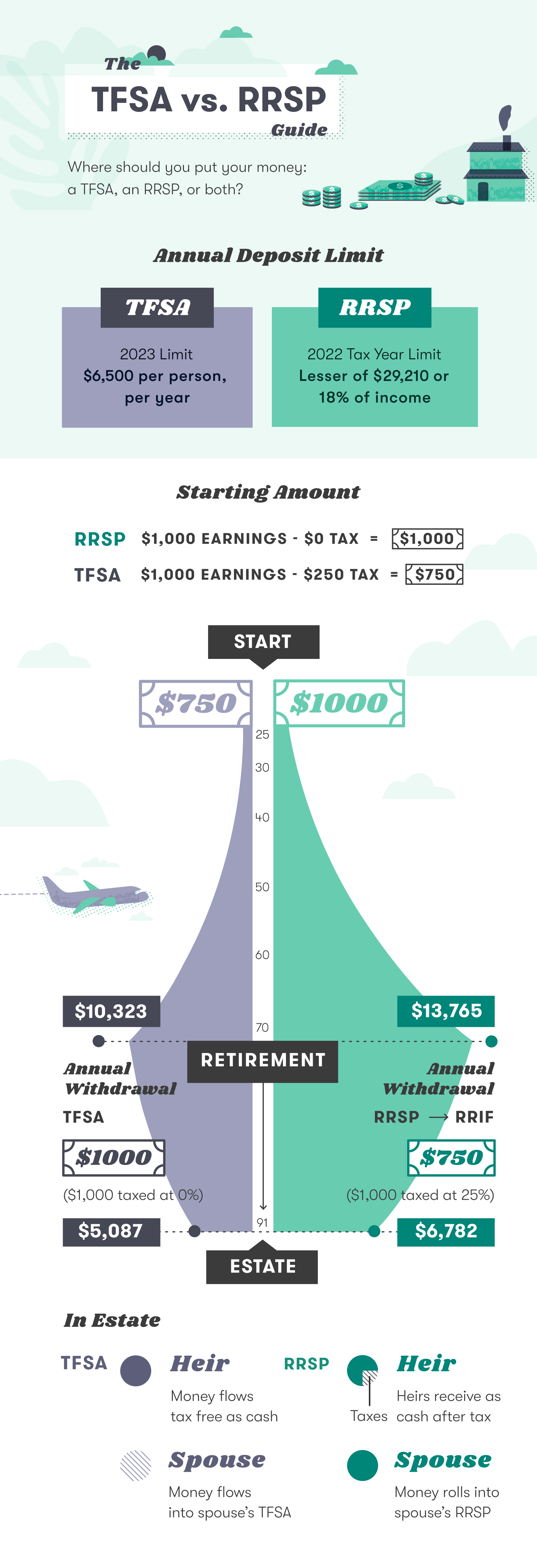

Which is better: RRSP or TFSA? The journey of $1000

Before we get into the nitty gritty, let’s look at an example. With so much debate online about which account is truly best for retirement savings, we decided to do some calculations of our own.

In the infographic below, we look at how $1000 could grow overtime when invested in a TFSA and an RRSP.

When it comes to long-term retirement savings, you can see how the RRSP comes out ahead. In this example, the money is invested when you’re 25 and withdrawn at 71. The income taxes you save upfront can grow into a big return over time when invested.

Keep in mind that with an RRSP, the funds are locked up until retirement and withdrawals are taxed as income, so the money in your account doesn’t all end up in your pocket. Meanwhile, with a TFSA, the full account balance is yours to spend as you wish, when you wish.

Now, let’s dive deeper into how each account works and find out which one is more beneficial for savings goals beyond retirement.

The differences between a TFSA and an RRSP

You can use a TFSA or an RRSP to store assets like cash or investments like stocks, bonds, mutual funds and other financial products.

But there are two major differences between them: how much you can contribute per year and how your assets are taxed.

How a TFSA works

For 2023, the annual amount that you can contribute to your TFSA is $6,500. Unused contribution room rolls over, so if you haven’t maxed out your contribution room in previous years, chances are you’ll have additional space.

The money you put in a TFSA has already been taxed, so there’s no tax break at the time you contribute. But here’s where the “tax free” part comes in—when you withdraw your assets, none of the growth on your investments is taxed in any way.

The fact that you pay tax now (before you contribute) and not later (when you withdraw) is important— it’s what makes TFSAs and RRSPs different and affects the saving strategy for each.

How an RRSP works

We’ve got a great article on everything you might want to know about how an RRSP works, but here’s a summary.

You can contribute up to 18% of the earned income you reported on your 2022 tax filing or $29,210 (whichever is less) to your RRSP, plus any amount that rolled over from previous years. Find out more on calculating the right amount.

When you put assets in your RRSP, you don’t pay income tax on it. Typically, that means you’ll see a bigger tax return in the spring. Sounds good, right? Here’s the catch, you’ll pay taxes on those assets when you eventually withdraw the money in retirement.

RRSP becomes a RRIF

Because the government wants to ensure that you use the money you save for retirement income specifically, eventually, you’ll convert your RRSP into a registered retirement income fund (RRIF). The main difference between the two account types is that while one is designed to help you save, the other forces you to make withdrawals. Once you convert your account to a RRIF, you can no longer make contributions—just withdrawals. You are required to convert your RRSP to a RRIF by the year you turn 71. Keep in mind, you don’t have to convert your RRSP to a RRIF to start taking retirement income before the year you turn 71—the choice to convert early is up to you.

Is it better to invest in a TFSA or an RRSP?

T-shirts vs. sweaters—either can be best, depending on your situation. TFSAs and RRSPs have their similarities, they’re both excellent options for long-term investing and offer tax advantages, but determining the best one depends on what you’re investing for.

Like the name suggests, the RRSP is typically going to be the best option if you’re investing specifically for retirement. That’s especially true if you’re in your peak earning years.

That said, if you’re a living, breathing human being, chances are you’ll need to spend money before retirement—and sometimes that requires shelling out a big chunk of change. A TFSA gives you the benefit of flexibility. The money is always available to you and you don’t need to consider taxes when you make withdrawals.

Most people have multiple savings goals and those goals can change overtime, so most people can likely benefit from contributing to both a TFSA and an RRSP.

Scenarios

Here are some goals you might be saving for and the best investing account to choose for each:

Goal: “I want to start an emergency fund.”

Account: TFSA. Money in a TFSA is available to you any time. Best part? When invested, it can keep growing while you keep saving. When you withdraw the money, it won’t be taxed—so the amount that appears in your account is the exact amount that ends up in your pocket.

Goal: “I’m making a big purchase next year.”

Account: TFSA. A TFSA is great for any and all short to medium savings.

Goal: “I’m saving for my first home."

Account: RRSP or Both. Thanks to the Home Buyers’ Plan (HBP), as a first time home buyer, you can withdraw up to $35,000 from your RRSP without paying taxes on the funds. You’ll have 15 years to gradually pay that money back. If you have a partner, they can do the same, effectively doubling the amount. That’s a tax advantage worth taking! But here’s the catch: if you live in one of Canada’s major cities, $35,000 or even $70,000 for a couple may not get you far towards a down payment. Investing through a TFSA will allow you to make up the difference.

Goal: “I’m saving for a bigger home.”

Account: TFSA. You don’t qualify for the Home Buyers’ Plan, so you definitely don’t want to dip into your RRSP and face steep tax consequences. No worries! Investing tax free through a TFSA is a great way to save towards your next home.

Goal: “I want a comfortable income in retirement.”

Account: RRSP. An RRSP is the best way to ensure you have an income in retirement that will cover the cost of living, and maybe even a little extra! Remember that the money will be taxed as annual income.

Goal: “I want to live larger in retirement.”

Account: TFSA. Your TFSA can be a great account for tax-free spending in retirement, which is particularly handy in years where you want to make a big purchase, or if you plan to spend more in retirement that you do today.

The TFSA vs. RRSP calculator

To get the most out of your investments, you’ll want to calculate where you’ll see the greatest tax benefit. That will depend on what you earn right now, what you’re saving for, and when you plan to use the money.

To help you see how your money could grow in either account, we’ve created a free and easy to use TFSA vs. RRSP calculator.

Have questions? Contact your local PPI Collaboration Centre.

Reposted with permission from CI Direct Investing.