Protecting Your Retirement with Critical Illness Insurance

It’s certain that you’re saving some of those hard-earned dollars for retirement, but have you implemented the important added step of protecting your investments in case of a severe illness?

While many retirement conversations revolve around RRSPs and their goal of helping you maximize your returns, another important conversation involves critical illness insurance and the way in which it can benefit you and those hard-earned savings by adding another layer of protection.

The fact is that if you suffer a critical illness and need to take time off work or pay for additional treatment, well, that income replacement or funding needs to come from somewhere. And if you don’t have insurance in place, you’re more likely to dip into your savings. However, there are better solutions including using critical illness insurance as retirement protection.

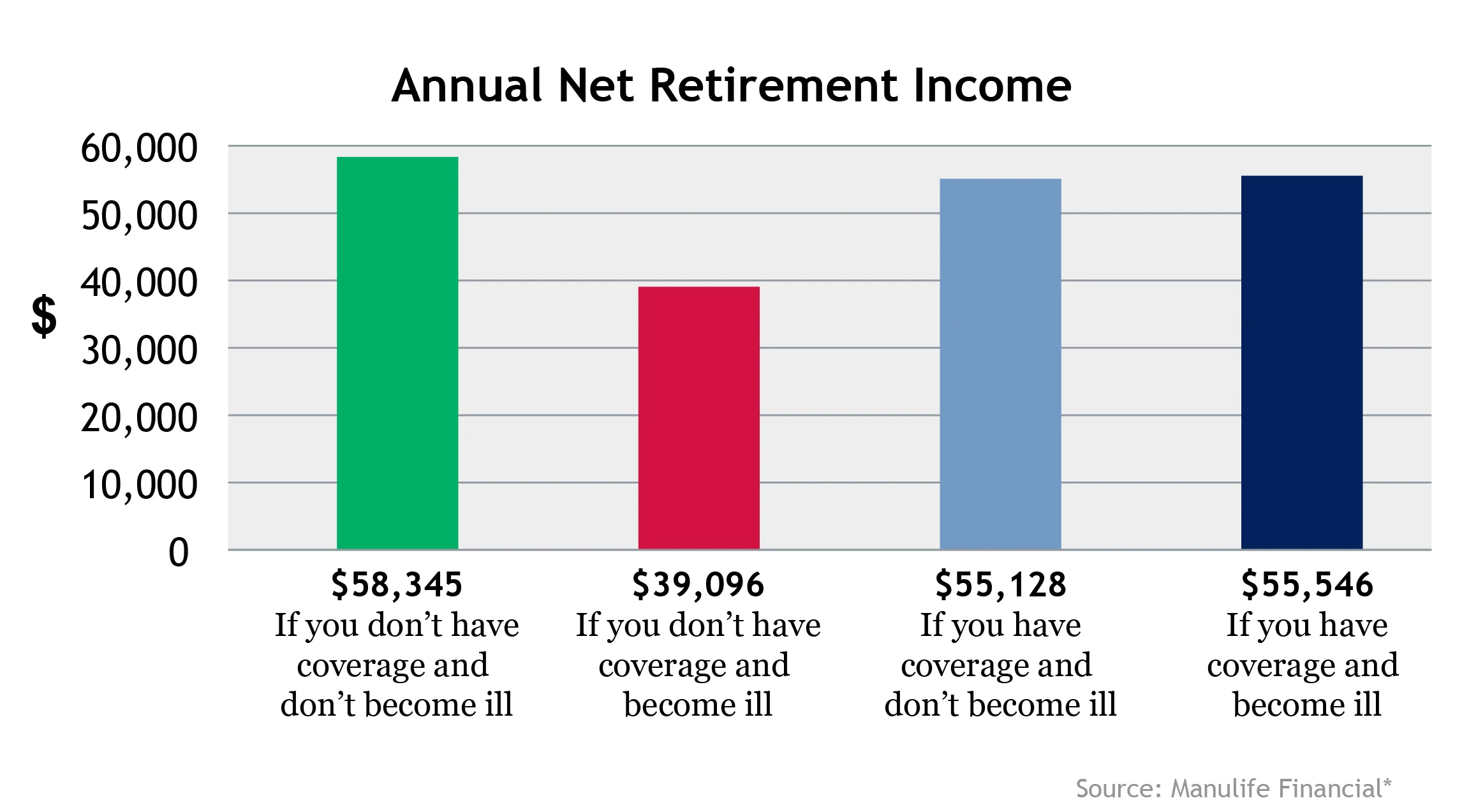

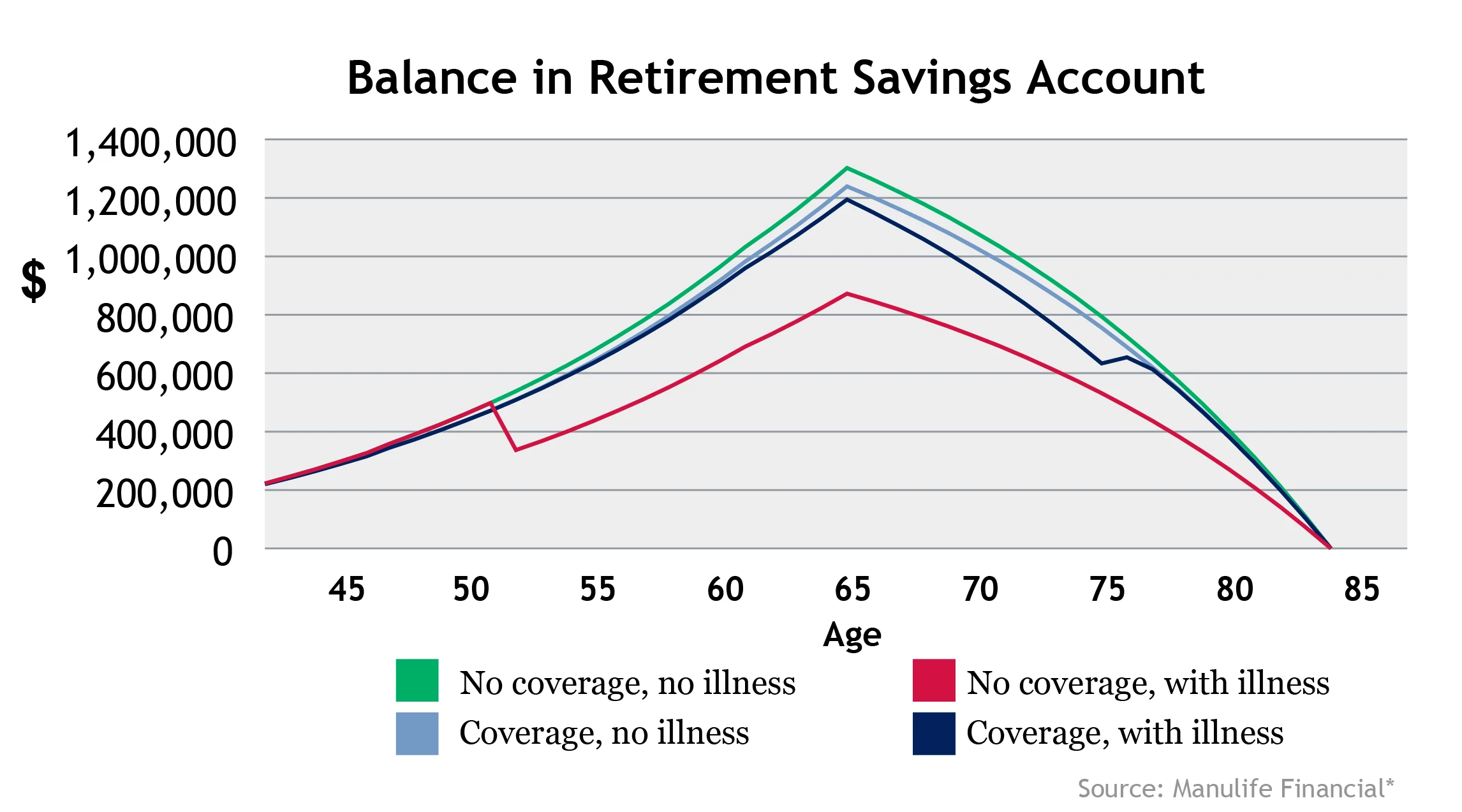

There are basically four options available to you, one of which is guaranteed to happen in your lifetime:

You don’t have CI coverage and never suffer an illness

You have CI coverage and never suffer an illness

You have CI coverage and do suffer an illness

You don’t have CI coverage and do suffer an illness

In a lifetime, any one of the above scenarios will apply to you… but the question is, which one? Unfortunately, this is the impossible part to predict! Most Canadians would like to believe their fate will lead them to option one. However, the sad reality is that not everyone will be so lucky.

Let’s take a look at an example to see the real-world impact to your annual net retirement income.

The above example assumes:

Male Age 40

$200,000 in RRSPs

Contributing $10,000

6% interest

$100,000 need at age 50 due to a critical illness

When you compare the ultimate annual retirement income in the scenarios in light blue and dark blue to the best-case scenario in green, you can see that the impact of redirecting a portion of your savings dollars to the purchase of critical illness insurance is minimal compared to the impact of becoming ill without critical illness protection. And, if you have additional cash flow, you can cover the cost of the critical illness insurance with no impact to your retirement income.

If you’re interested in learning more about critical illness insurance and the protection it provides, read Critical Illness Insurance – Financial Protection Or Your Money Back! Also, be sure to take this Strengthening Your Safety Net quiz to help you assess the risks in your life and the likelihood of them occurring.

Have questions? Please contact our office.

References

*Source: Manulife Financial LifeCheque Retirement Protect illustration for male age 40, assuming $200,000 in existing RRSPs, contributing $10,000 annually, at 6% annual interest, with $100,000 required at age 50 due to critical illness. Illustrated on January 4, 2022.